Barger & Associates delivers comprehensive coverage solutions that protect your household from financial disruptions caused by flooding, property damage, liability claims, and vehicle accidents. Our independent agents evaluate multiple carrier options to identify policies providing adequate protection at competitive premium rates for this affluent Fort Bend County community. Call (469) 341-4411 today to secure coverage that safeguards your most valuable assets.

Selecting appropriate coverage requires understanding coastal flooding risks and policy exclusions that threaten properties in subtropical environments prone to heavy rainfall. Our agency maintains access to diverse carrier networks specializing in flood protection beyond what captive agents offer through single-company relationships. We provide ongoing policy management and claims assistance as your circumstances evolve throughout hurricane seasons and different life stages.

Your vehicle, home, loved ones, and valuables all need protection, and we provide it through comprehensive coverage solutions as your trusted:

Stay protected on the road with coverage that fits your life. From fender benders to major accidents, our auto insurance helps keep you and your vehicle covered.

Protect your home from the unexpected. Our home insurance covers everything from fire and storm damage to theft and liability, giving you peace of mind where it matters most.

Extra coverage when you need it most. Umbrella insurance adds an extra layer of protection beyond your standard policies to help cover large claims or lawsuits.

Your belongings matter. Our renters insurance helps cover your valuables from theft, fire, and other covered losses so you’re protected even if you don’t own the property.

Hit the road with confidence. Our motorcycle insurance offers protection for you and your bike, covering accidents, theft, and more so you can ride worry-free.

Our team provides transparent guidance regarding policy terms and exclusions that determine claim outcomes during hurricane recovery periods. We conduct annual coverage reviews to verify protection remains sufficient as property values increase and household circumstances evolve. Clients receive dedicated support throughout the policy lifecycle, not just during initial purchase transactions.

Here are the advantages of working with our agency:

Our agency assists residents throughout the entire city with policy selection, claims support, and coverage updates tailored to individual circumstances. We maintain flexible appointment scheduling to accommodate working professionals and families managing demanding schedules throughout the week. Understanding local property characteristics helps us recommend coverage addressing flooding risks and subtropical climate factors.

Here are the following neighborhoods we serve:

Commonwealth

Covington Woods

First Colony

Greatwood

New Territory

Riverstone

Sienna Plantation

Sweetwater

Telfair

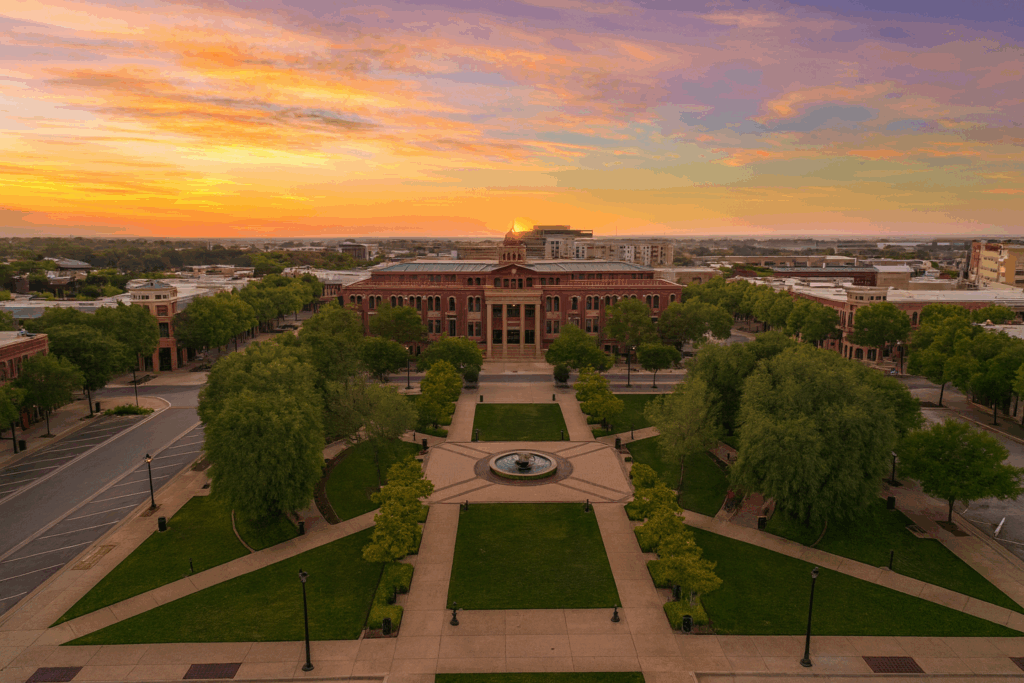

Town Square

Adequate coverage prevents catastrophic financial losses from depleting savings accounts when tropical storms and heavy rainfall events strike coastal communities. Our agents simplify policy comparison by explaining how flood exclusions, windstorm deductibles, and coverage limits affect both premium costs and claim payouts. We translate complex insurance terminology into practical language that clarifies your actual protection levels.

Contact Barger & Associates to schedule a comprehensive policy evaluation or call (469) 341-4411 to discuss coastal coverage options with an experienced agent.

Standard policies exclude flood damage entirely, requiring separate federal flood insurance through the National Flood Insurance Program regardless of official flood zone designations. Heavy rainfall events and proximity to the Houston metropolitan drainage system demonstrate that properties throughout the area face substantial water intrusion risks requiring adequate flood coverage.

Heat and humidity accelerate deterioration of roofing materials, HVAC systems, and exterior surfaces requiring more frequent maintenance than moderate regions. Tropical storm and hurricane exposures during Gulf Coast weather events necessitate windstorm provisions and named storm deductibles that apply as percentages of dwelling coverage.

Neighborhood pools, parks, and recreational facilities maintained by homeowners associations generally transfer liability away from individual property owners. HOA architectural guidelines may affect rebuilding requirements and material specifications that influence replacement cost calculations and dwelling coverage limits.

Highly regarded educational institutions contribute to strong property values that affect replacement cost calculations for dwelling coverage. Regular policy reviews ensure coverage limits keep pace with appreciation driven by desirable school zones and premium community amenities.

Detached structures and luxury outdoor amenities require separate coverage limits beyond standard dwelling protection. Scheduled endorsements provide proper protection for expensive features including pool equipment, outdoor appliances, and permanent landscaping that standard policies may exclude or limit.

State regulations mandate $30,000 per person for bodily injury, $60,000 per accident, and $25,000 for property damage. Affluent suburban residents should consider significantly higher limits to protect assets from lawsuit judgments following accidents in densely populated metropolitan areas.